NEWYou can now listen to Fox Information articles!

Whilst President Biden has floated the notion of canceling “some” student loan personal debt — an plan each GOP and Democrat lawmakers alike are alarmed by, expressing it would charge the governing administration way too a lot cash and incorporate to inflation — some college graduates with major personal debt loans usually are not waiting close to for somebody or anything to bail them out.

They’re pushing ahead, undertaking what is actually proper — and figuring out a way to shell out off their own debt.

And for just one Rutgers University graduate, that included a novel concept.

New Jersey native Pathik Oza graduated in 2018 with a B.A. from Rutgers University — he researched psychology and biology — with $70,000 in college student financial loans, he instructed Fox Information Electronic in an job interview.

OHIO Couple, Parents OF TWO, GET Large Scholar Mortgage Personal debt Behind THEM

And when Oza started pursuing yet another diploma in advance of his plan to attend medical faculty, he also observed a enthusiasm for rehoming utilised and discarded books.

“I was walking about 1 day all through the summer season, and I saw guides lying there, and I imagined there would be an opportunity,” he said.

O3 Guides founder Pathik Oza of North Brunswick, N.J., through a recent Zoom job interview with Fox News Digital about shelling out down his scholar personal debt. “I just started off this volunteer get the job done the place I would accumulate unwanted publications,” he stated.

(Fox Information Digital)

“Why would books be thrown away? They could be redistributed to someone who may perhaps want them. So I just begun this volunteer function exactly where I would acquire undesirable publications,” he explained to Fox News Electronic.

What started as a type gesture and a prospect to give back again to nearby libraries, schools, shelters and children’s hospitals turned into a glowing new enterprise chance.

An increasing variety of requests for guides and a significant demand for his products and services grew to become a thing significantly far too massive for just Oza and his Toyota RAV4 to tackle.

Pathik Oza made the selection to turn reselling textbooks into a lucrative business enterprise.

So Oza created the decision to flip reselling books into a business enterprise. He begun off by opening an Amazon account.

He named his small business O3 Books.

FLORIDA-Based mostly Mother PAYS OFF $40K IN Scholar Debt Soon after Residing ‘PAYCHECK TO PAYCHECK’

“The income would hold coming in, and it retained developing,” he said. “[In about] a month or so, I experienced all around 1,000 to 2,000 textbooks in Amazon warehouses. So it was really great to see the expansion in the organization.”

Oza ongoing to increase by launching a web site and opening an Etsy store, which “blew up” though the globe was locked down throughout the coronavirus pandemic.

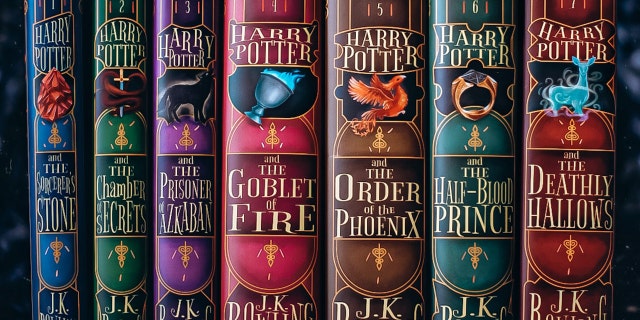

O3 Books’ authentic dust jacket designs for J.K. Rowling’s “Harry Potter” guide sequence are shown below. (Pathik Oza/O3 Guides)

He also discovered that there was in particular high demand from customers for his décor ebook sets and redesigned dust jackets he moved in that course to help spruce up the backgrounds of operate-from-home Zoom meetings.

By the conclusion of 2020, Oza experienced produced $115,000 from his aspect company — which included his university student financial loans in entire, and then some.

Oza learned “a ton about finances,” he stated, by spending off his loans and by fueling his individual modest enterprise at the identical time.

Oza stated he uncovered “a lot about finances” by spending off his loans and by fueling his own organization at the exact time.

OHIO Writer Compensated OFF $48K IN University student Financial loans IN 14 MONTHS: IT WAS ‘AN ADVENTURE’

Today, the 25-year-aged claimed he would really feel “a lot more comfy” having on diverse kinds of borrowing in the upcoming dependent on the economical knowledge he’s accrued.

The achievement of O3 Textbooks is now shelling out for Oza’s second degree in comprehensive, doing away with the load of needing to get out a further bank loan.

Pathik Oza of N.J. commenced O3 Guides — and employed the dollars he built from his new organization to absolutely spend off his scholar loan credit card debt.

(Pathik Oza)

The compact organization proprietor has considering that switched job paths.

He’s been pursuing a degree in computer system science, although the thought of significant med university financial loans perhaps in his foreseeable future gave him an extra enhance to just take treatment of financial debt he presently had.

“I felt it was urgent to pay back those people off,” he stated.

HOW TO Make a decision WHICH University student Loans TO Pay back OFF Initially

For other pupils with debt who are on the lookout for a way to shell out down their financial loans, Oza said weighing the choice of starting off a modest business is a good plan. He especially recommended using advantage of on the web marketplaces like Amazon and Etsy.

“Any passion you’ve started out, there is definitely a current market for it,” he explained.

“You only want a tiny part [of the population] to [help] generate income in sales. As long as you have 1% of the clients, you have a comprehensive-fledged company,” he added. “There’s always a market place for a thing.”

Escalating his individual organization has supplied Oza a boost in conditions of financial literacy, so he also recommended that saving and investing one’s revenue is constantly the “finest solution.”

ROWE: Idea OF CANCELING Pupil Financial loan Financial debt ‘MAKES ME CRAZY’

“Make guaranteed to recognize finances and how you can ideal allocate your income,” he stated. “Loans are a load no just one needs — but you will get rid of them.”

O3 Books founder Pathik Oza shared thoughts for other college students with financial debt to shell out down their loans. “Social media has opened up numerous opportunities to market place your competencies and permit you to generate a side or potentially whole-time income,” he explained.

(Pathik Oza)

Oza hopes one day to leave O3 Books with his mom and dad — as a continual outlet for added profits. In other terms, he needs it to remain in the spouse and children.

“This is an awesome facet profits I’ll hold forever,” he explained. “I created a brand about it. I designed a neighborhood all-around it. So, it is a thing I cannot allow go.”

“There is a industry for your talent and there are many platforms you can use to showcase your ability.”

Oza also shared more ideas for anyone needing additional revenue or funds to fork out down their pupil credit card debt.

“I would counsel obtaining a element-time job — and if you do not have that substantially time, then use individuals out there several hours to make money with a talent you have,” he mentioned.

Click on In this article TO Signal UP FOR OUR Life-style E-newsletter

“It could be just about anything like advertising and marketing, art, website structure, application enhancement or instructing … There is a market for your talent and there are a lot of platforms you can use to showcase your skill.”

“For case in point,” he added, “Instagram is an outstanding place for artists to showcase their artwork … The most effective component about this is you can function when you are accessible.”

Click Listed here TO GET THE FOX Information App

Claimed Oza, “Social media has opened up quite a few chances to market place your skills and let you to create a aspect or possibly total-time income from a passion or talent you have. Yet again, if your circumstance enables you to do this, consider to lessen your shelling out expenditures as significantly as attainable.”

More Stories

3 Donor Relations Recommendations to Freshen Up Your Fundraising Endeavours

Make Your Fundraising Plans Smart!

How Donors Need to Assess a Charity Before Supplying a Donation